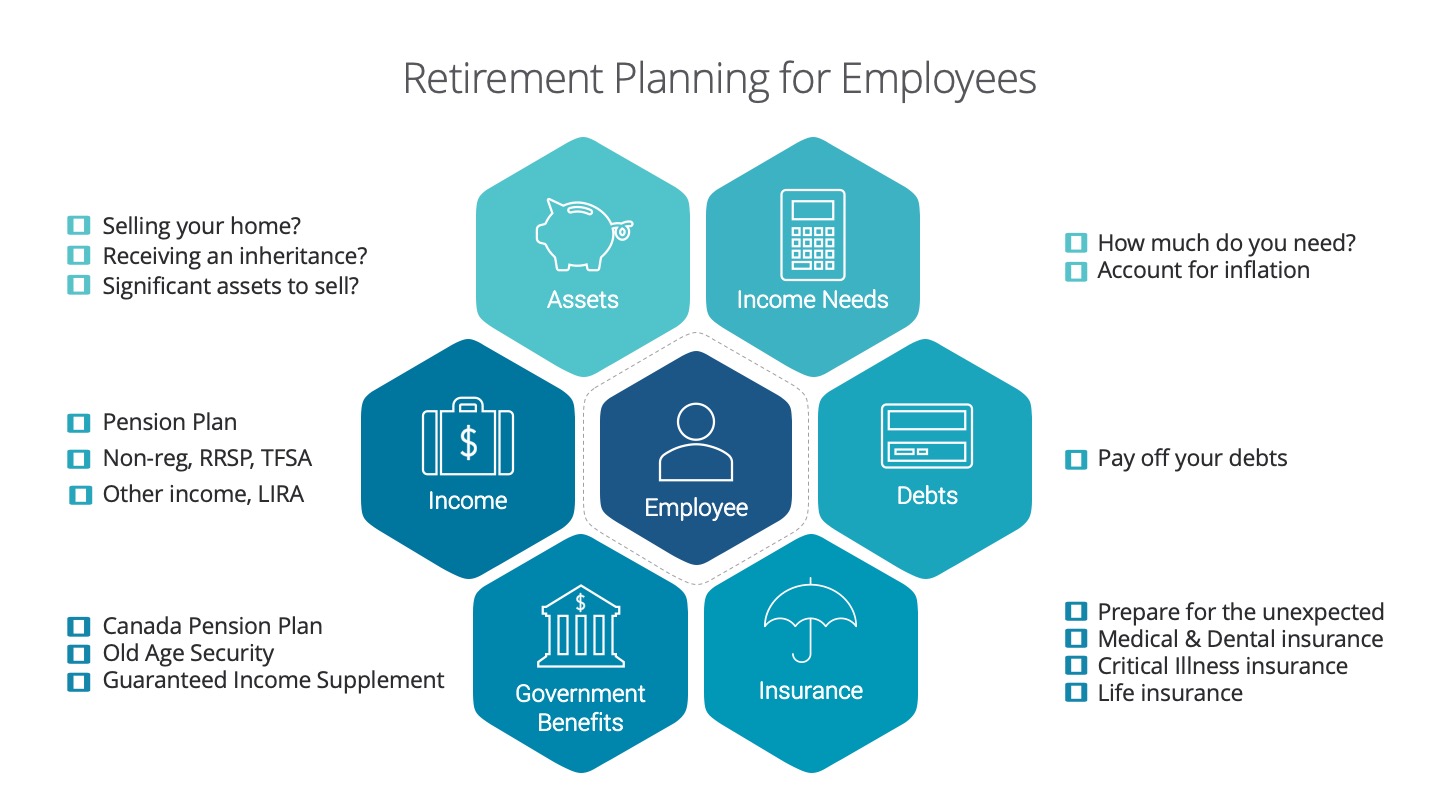

Retirement Planning for Employees

When thinking about retirement, it can be overwhelming to figure out all the numbers, like what age you’re going to retire, how much money you need and how long do you need the money to last.

We’ve put together an infographic checklist that can help you get started on this. We know this can be a difficult conversation so we’re here to help and provide guidance to help you achieve your retirement dreams.

Income Needs

-

Determine how much you need in retirement.

-

Make sure you account for inflation in your calculations

Debts

-

If you have any debts, you should try to pay off your debts as soon as you can and preferably before you retire.

Insurance

-

As you age, your insurance needs change. Review your insurance needs, in particular your medical and dental insurance because a lot of employers do not provide health plans to retirees.

-

Review your life insurance coverage because you may not necessarily need as much life insurance as when you had dependents and a mortgage, but you may still need to review your estate and final expense needs.

-

Prepare for the unexpected such as a critical illness or long term care.

Government Benefits

-

Check what benefits are available for you on retirement.

-

Canada Pension Plan- decide when would be the ideal time to apply and receive CPP payment. (Payment depends on your contributions)

-

Old Age Security- check pension amounts and see if there’s a possibility of clawback.

-

Guaranteed Income Supplement- if you client have a low income, you could apply for GIS.

Income

-

Review your company pension plan. Check if it’s a defined benefits or contribution plan. Determine if it makes sense to take the pension or the commuted value.

-

Make sure you are saving on a regular basis towards retirement- in an RRSP, TFSA, LIRA or non-registered. Ensure the investment mix makes sense for your situation.

-

Don’t forget to check if there are any income sources. (ex. rental income, side hustle income, etc.)

Assets

-

Are you planning to use the sale of your home or other assets to fund their retirement?

-

Will you be receiving an inheritance?

One other consideration that’s not included in the checklist is divorce. This can be an uncomfortable question, however divorce amongst adults ages 50 and over is on the rise and this can be financially devastating for both parties.

Next steps…

-

Contact us about helping you get your retirement planning in order so you can gain peace of mind that your family is taken care of.